Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back: If you get a.Of a TurboTax calculation error, we’ll pay you the penalty and interest. 100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because.

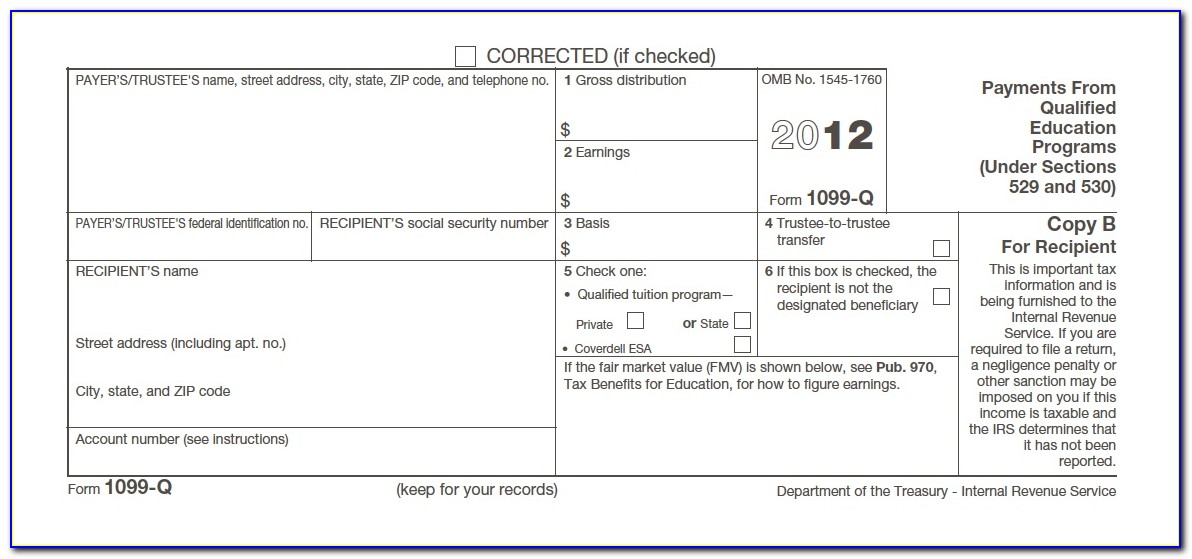

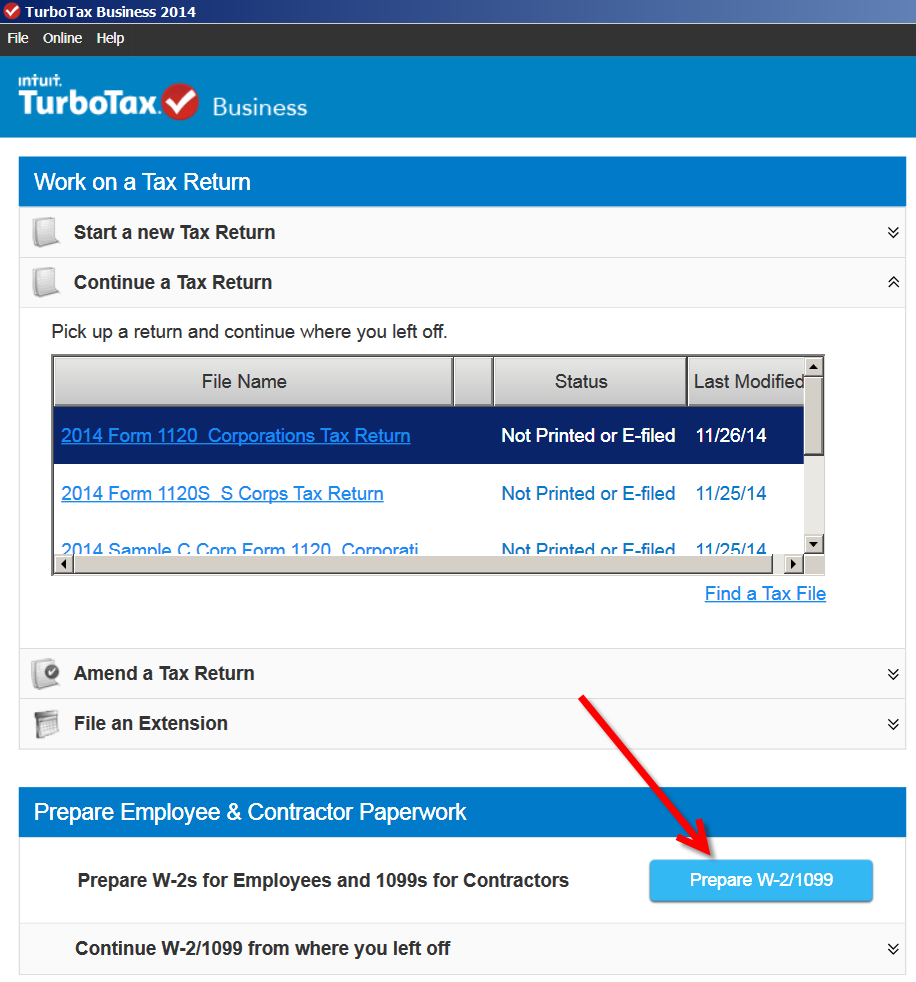

We’ll search over 500 tax deductions to get you every dollar you deserve and help you uncover industry-specific deductions. Perfect for independent contractors and small businesses. TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. Other information reported on the form will now show in renumbered boxes.The biggest adjustment comes to Box 7, which previously reported nonemployee compensation but now reports direct sales of $5,000 or more.What about Form 1099-MISC?īecause the IRS removed reporting for nonemployee compensation from Form 1099-MISC for tax year 2020 and onward, the IRS redesigned that form as well.

Generally, payers need to file these forms by January 31 and have no automatic 30-day extensions to file unless the business meets certain hardship conditions.

Turbotax 1099 professional#

Fees paid by one professional to another, such as fee-splitting or referral fees.Professional service fees, such as fees to attorneys (including corporations), accountants, architects, contractors, etc.Commissions paid to nonemployee salespeople that are subject to repayment but not repaid during the year.The IRS provides a more comprehensive list of the types of payments that would be reported in Box 1. Payments to individuals that are not reportable on the 1099-NEC form, would typically be reported on Form 1099-MISC.The nonemployee compensation reported in Box 1 of Form 1099-NEC is generally reported as self-employment income and likely subject self-employment tax.Instead, your form should only report payments made as compensation related to the company’s trade or business. Self-employed individuals should not see personal payments made to them during the year on the new form. What details do I need to know about the 1099-NEC form update? Other forms of compensation for services performed for your trade or business by an individual who is not your employee.Prizes and awards for services performed by a nonemployee.The payment total is at least $600 for the yearĪdditionally, businesses will need to file Form 1099-NEC if the business has withheld any federal income tax under the backup withholding rules regardless of the amount of payments for the year to the nonemployee.The payment is made to an individual, partnership, estate, or in some cases a corporation.The payment is made for services in the course of your trade or business.The payment is made to someone who is not your employee.The IRS explains that, in general, you must report payments you make if they meet the following four conditions: In order to help clarify the separate the various filing deadlines when reporting different types of payments on Form 1099-MISC, the IRS decided to reintroduce Form 1099-NEC which has a single filing deadline for all payments that use the form. These payments generally represent nonemployee compensation and, up until now, would typically appear in box 7 of 1099-MISC. Since then, prior to tax year 2020, businesses typically filed Form 1099-MISC to report payments totaling $600 or more to a nonemployee for certain payments from a trade or business. You should receive these forms by January 31 each year and use them to prepare your tax return.īefore its reintroduction, the last time form 1099-NEC was used was back in 1982.You can expect to receive this new form from a business that paid you $600 or more for nonemployee compensation in tax year 2020 or later.Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor.

For information on the third coronavirus relief package, please visit our “ American Rescue Plan: What Does it Mean for You and a Third Stimulus Check” blog post.īeginning with the 2020 tax year, the IRS will require businesses to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC.

0 kommentar(er)

0 kommentar(er)